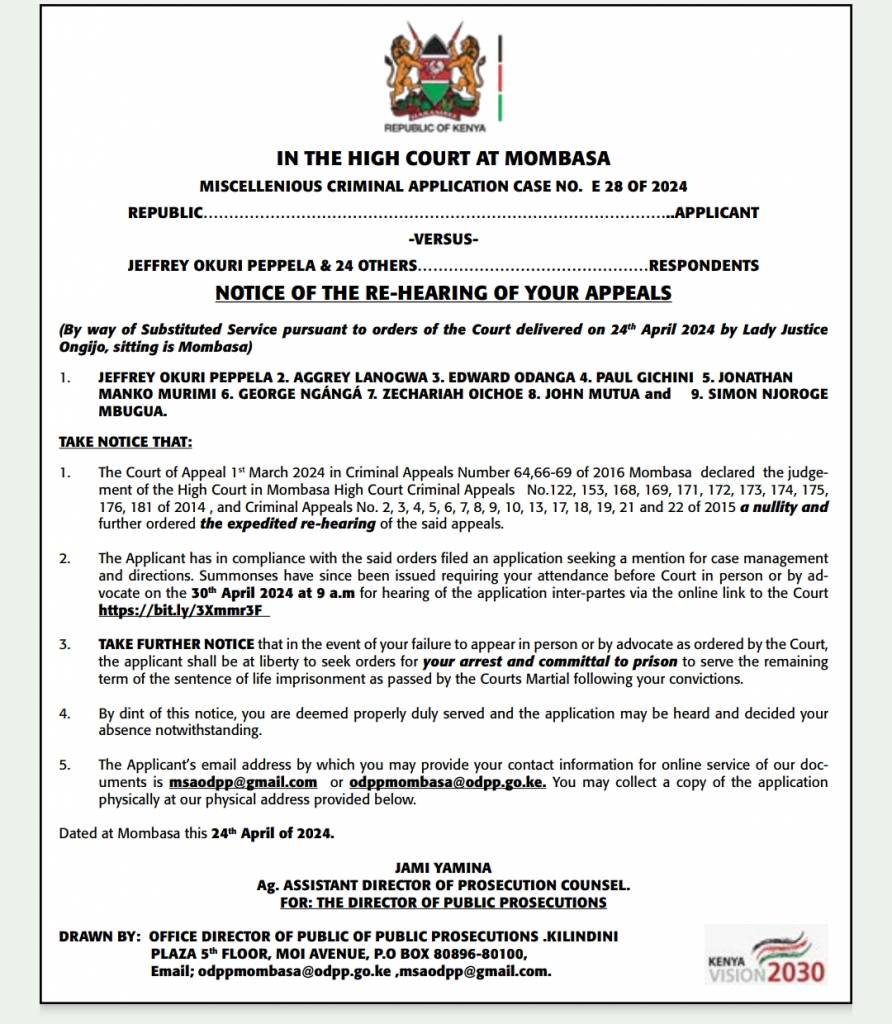

- HIGH COURT–MISCELLENOUS CRIMINAL APPLICATION CASE–QTR

- KENYA AIR FORCE HOLDS REQUIEM MASS FOR ITS FALLEN HEROES

- A FRIEND IN NEED

- SOMALIA EXTENDS CONDOLENCES TO KENYA’S DEFENCE LEADERSHIP

- COUNTRY BIDS FAREWELL TO GENERAL OGOLLA IN SIAYA COUNTY

- MILITARY HONORS AND MEMORIAL SERVICE FOR GENERAL FRANCIS OMONDI OGOLLA

- PRESS STATEMENTS & UPDATES

- STATEMENT ON ARREST OF KDF SOLDIERS IN LODWAR

- MILITARY AND CIVILIAN OFFICIALS TRAINED IN PERFORMANCE CONTRACTING

- CS DUALE BREAKS GROUND FOR CONSTRUCTION OF NEW BLOCK AT NDC

- ENHANCING ROAD SAFETY AMONG KDF DRIVERS

- PHYSICAL FITNESS FOR ONE FORCE ONE MISSION

The Executive Order No. 2 of 2023 (Dated 1st November 2023) created the Ministry of Defence. The work of the Ministry of Defence is informed by the Constitution of the Republic of Kenya. The Ministry is obliged to facilitate and support the Kenya Defence Forces (KDF) in the discharge of their mandate under Article 241 (3) (a), (b) & (c) of the Constitution.

OUR MISSION

To defend and protect the sovereignty and territorial integrity of the Republic, assist and cooperate with other authorities in situations of emergency or disaster and restore peace in any part of Kenya affected by unrest or instability as assigned.

OUR VISION

A premier, credible and mission capable force deeply rooted in professionalism.

OUR COMMITMENT

The Ministry of Defence is committed to defending and protecting the people of the Republic of Kenya and their property against external aggression and also in providing support to the Civil Authority as per the Law.

HUMANITARIAN CIVIC ACTION

OUR LEADERS

SERVICE COMMANDERS

Lt Gen David Tarus CBS ‘ndc’ (K) ‘cgsc’ (USA) ‘psc’ (K)

Commander Kenya Army

Maj Gen J M Omenda MGH EBS SS OGW ‘rcds'(UK) ‘psc'(K)

Commander Kenya Air Force

Maj Gen Thomas Ng’ang’a EBS HSC ‘ndu’ ‘psc'(USA)

Commander Kenya Navy